Digitally connecting vehicles to one another and to their environment does not just mean new opportunities for passenger transport. It also offers commercial vehicle fleets great potential to substantially reduce operating costs. In our third and final part in the series “The Future of the Truck” we shall look at this diverse subject in more detail.

Commercial Vehicles as Part of Digital Infrastructure

Nowadays, numerous applications share data via interfaces to the technical information devices installed in fleet vehicles. For example, when recording, saving and archiving driver and vehicle data that modern tachographs, practical download tools and smart fleet management software have long been able to automate. Information about the condition of vehicles and trailers, service intervals and cold chains is also already being shared and analyzed digitally. And routes, and loading and delivery processes, have long since been optimized using real-time position data which vehicles send to their control centers.

The data gathered for these purposes is important information from many different sources, each of which delivers results which are valuable in and of themselves. But it is only when all these data sources are connected to each other in a meaningful way that “connectivity” can generate its full impact. So the term refers to a digital infrastructure which most benefits those who are able to fully exploit it.

The Truck as Part of the “Internet of Everything.”

TIS-Web Motion shows how something like this might look. This smart fleet management software links driving and driver rest periods to vehicle status and position data. In this way, fleet managers can add things like upcoming services to their schedules. Using the TruckOn digital booking platform, they can schedule service appointments with appropriate repair shops along the routing. When well planned, thanks to automated data sharing, the driver can use the resulting down time to take a break from driving or as a rest period.

Driving styles can be optimized based on the data material, and personalized bonus systems can be used to motivate individual drivers and thereby make a career plagued by recruitment issues more appealing.

Collective Intelligence Through Networking.

But the future promises far more. Because, once the vehicle is communicating as part of an entire digital infrastructure with other vehicles (V2V), or via every other possible interface with its environment (V2X), the full power of this type of all-round networking can be deployed.

eHorizon, for example, is based on the idea of the “collective intelligence” of all vehicles. Their sensors can be used to send information about routes, road conditions or traffic to a cloud, from where other vehicles can access it. In this way, trucks get detailed information about route issues such as temporary speed limits, road works or wet surfaces. And all this is well before they reach the relevant location. Continental's dynamic eHorizon, for example, will be able to look several miles ahead and respond, automatically and optimally, to whichever situation is approaching with the help of the Eco Coasting function.

Source: Continental AG

Big Data in the Logistics and Transport Sector.

As in other business sectors, transport and logistics is likely to ultimately find its “real gold” in Big Data. It is not only new business rules for the specific work steps that can be derived from correlations within large data inventories. Third-party providers having access to a fleet's data material could also lead to completely new business models.

To this end, VDO is already offering smart interfaces that can be used to upload tachograph data to a cloud or extract it from the cloud. This type of “standard” platform does not just benefit managers of mixed fleets who get the chance to use a standard fleet management software package. The data material can also be used to acquire a deeper understanding of the transport market or interdependencies in the logistics processes. Third-party providers, too, get the opportunity to develop totally new services and thereby improve efficiency in the process as a whole. For example, insurance companies could offer bespoke policies based on the cargo, route or driver, and purely for the duration of that particular transport job. Primarily, though, the potential lies in merging data pools from different systems. For example, loading and unloading at loading bays could be optimized. Because if loading bay systems communicated with fleet management systems, handling could be fine-tuned and expensive queuing avoided.

Drivers' everyday work could also be made easier using the principle of connectivity. Imagine parking lots at interstate service areas having electronically controlled barriers. By linking tachograph data on driving and rest periods with the booking systems for these parking lots, they could be automatically reserved for the end of the working period. Drivers would no longer have to spend time and get stressed looking for a parking spot.

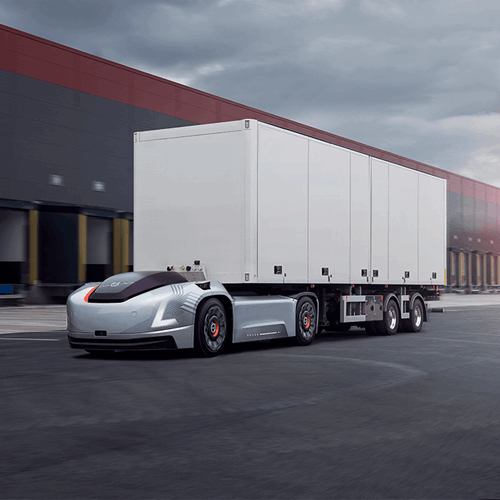

Playing with ideas like this shows that growing connectivity and increasing networking not only generate potential for greater fleet operation efficiency, but might result in entirely new business models in the future. A future in which fully connected, self-driving trucks with alternative engines will very much have their own place.